5807.90.05

Of cotton or man-made fibers

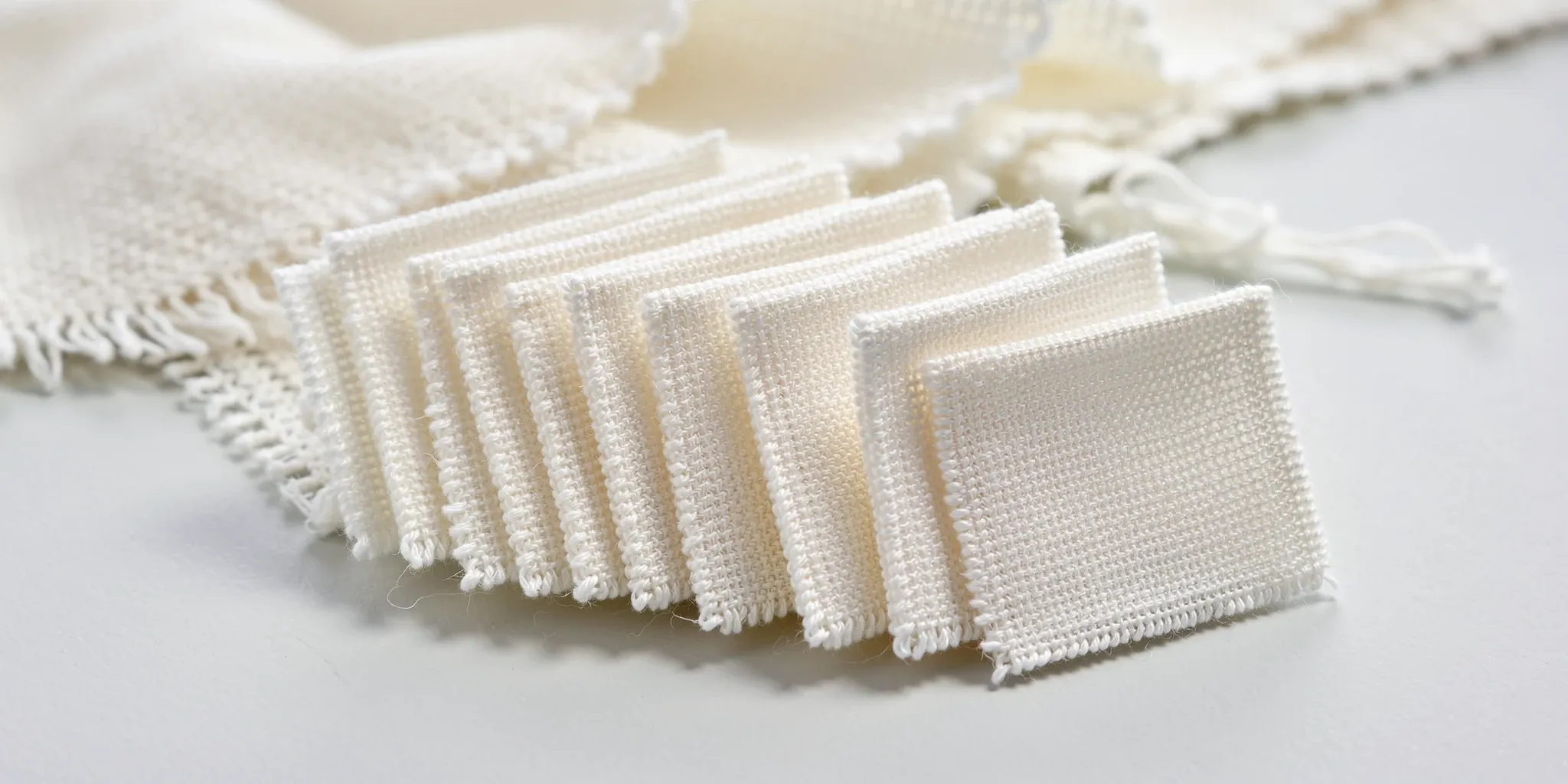

This code covers labels, badges, and similar textile articles made of cotton or man-made fibers, not embroidered. Use this code when importing these non-embroidered textile labels and badges, keeping in mind a general duty of 7.9% applies, unless the goods qualify for free trade benefits from specific countries like Australia or South Korea, as detailed in the duty information.

Detailed information for HTS Code 5807.90.05

AI Summary

This tariff classification falls within Chapter 58, which covers textile fabrics and related products like labels and trimmings. Specifically, code 5807.90.05 covers labels, badges, and similar articles made of cotton or man-made fibers that are not embroidered. This code has two subdivisions: 5807.90.05.10 for labels made of 100% cotton and 5807.90.05.20 for labels made of other cotton or man-made fiber combinations; use the appropriate suffix based on the material composition of the label.

| Chapter | Chapter 58 - Special woven fabrics; tufted textile fabrics; lace, tapestries; trimmings; embroidery |

| Section | Section XI - Textile and Textile Articles |

Duty snapshot

Quick reference for the duty outcomes tied to this HTS line.

7.90%

Standard trade partners (NTR)

Free (AU,BH, CL,CO,IL,JO,KR, MA,OM, P,PA,PE,S,SG)

Eligible FTA or preference programs

The general duty rate for HTS code 5807.90.05 is 7.90% and applies to imports in kilograms. Special rates of Free apply to eligible goods originating from Australia, Bahrain, Chile, Colombia, Israel, Jordan, Korea, Morocco, Oman, Panama, Paraguay, Peru, Singapore, and the U.S. Free Trade Agreement partners. These special rates apply to both subdivisions 5807.90.05.10 (Of cotton) and 5807.90.05.20 (Other) provided the goods meet the rules of origin for those respective programs; otherwise, the 7.90% general rate applies. There are no other specified duty rates.

Rate of Duty (Column 2): 71.50%

Need help importing?

_

Submit your details, and our team will confirm the correct classification and answer your questions.

Code subdivisions

5807.90.05.10

Labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered: > Other: > Labels: > Of cotton or man-made fibers > Of cotton (369)

5807.90.05.20

Labels, badges and similar articles of textile materials, in the piece, in strips or cut to shape or size, not embroidered: > Other: > Labels: > Of cotton or man-made fibers > Other (669)

Chapter & section notes

Chapter notes

Section notes

Latest update

Last updated

November 15, 2025

Revised every January & July

Let's get your shipment cleared

Submit your details and our team will help with classification and compliance.