7306.19.10

Of iron or nonalloy steel

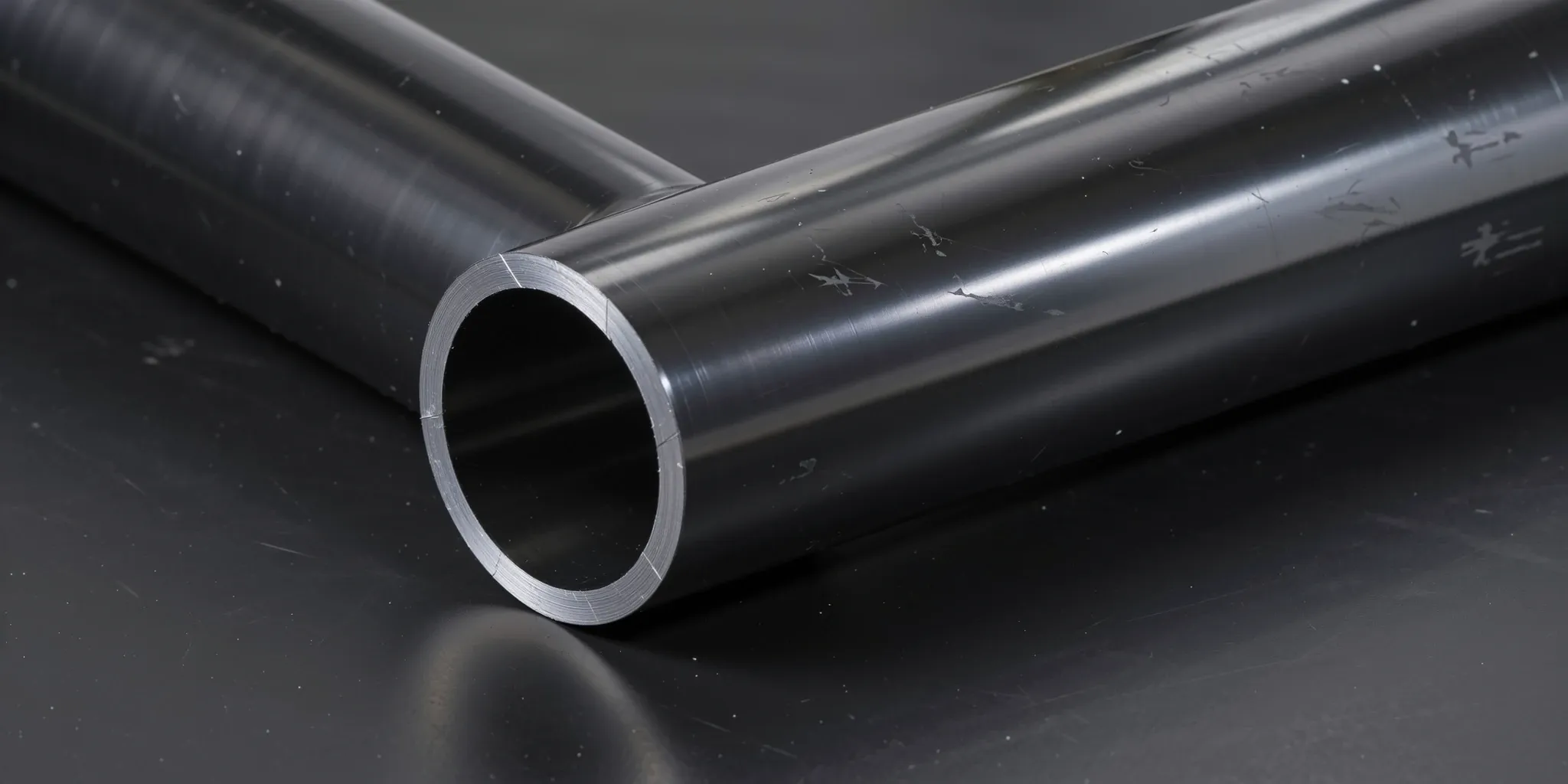

This code covers line pipe made of iron or nonalloy steel, specifically for oil or gas pipelines, and is further divided by outside diameter. These items generally enter the U.S. duty-free, as indicated by the “Free” general duty rate, and fall within Chapter 73 which broadly covers articles of iron or steel.

Detailed information for HTS Code 7306.19.10

AI Summary

This tariff code falls within Chapter 73, which covers articles of iron or steel. Specifically, 7306.19.10 covers tubes, pipes, and hollow profiles of iron or nonalloy steel used as line pipe for oil or gas pipelines, excluding those exceeding 114.3 mm in outside diameter or not exceeding 114.3 mm. The statistical suffixes .10 and .50 indicate the outside diameter of the pipe – use .10 for diameters not exceeding 114.3 mm and .50 for diameters exceeding 114.3 mm.

| Chapter | Chapter 73 - Articles of iron or steel |

| Section | Section XV - Base Metals and Articles of Base Metal |

Duty snapshot

Quick reference for the duty outcomes tied to this HTS line.

Free

Standard trade partners (NTR)

N/A

Eligible FTA or preference programs

The general duty rate for HTS code 7306.19.10 and its subdivisions (7306.19.10.10 and 7306.19.10.50) is Free, indicating no duty is assessed on imports meeting the code’s criteria. This applies to all subdivisions as well. A special rate is not specified, however, imports may qualify for preferential treatment under Eligible FTA or preference programs. Reporting units are in kilograms (kg). Standard trade partners (NTR) are subject to the general rate. Additional U.S. Notes clarify that tubes and pipes with attached fittings for conducting liquids or gases may be eligible for a “Free (C)” special rate, but this is not universally applied to the main code or its subdivisions.

Rate of Duty (Column 2): 5.50%

Need help importing?

_

Submit your details, and our team will confirm the correct classification and answer your questions.

Code subdivisions

7306.19.10.10

Other tubes, pipes and hollow profiles (for example, open seamed or welded, riveted or similarly closed), of iron or steel: > Line pipe of a kind used for oil or gas pipelines: > Other: > Of iron or nonalloy steel > With an outside diameter not exceeding 114.3 mm

7306.19.10.50

Other tubes, pipes and hollow profiles (for example, open seamed or welded, riveted or similarly closed), of iron or steel: > Line pipe of a kind used for oil or gas pipelines: > Other: > Of iron or nonalloy steel > With an outside diameter exceeding 114.3 mm

Chapter & section notes

Chapter notes

Section notes

Latest update

Last updated

November 15, 2025

Revised every January & July

Let's get your shipment cleared

Submit your details and our team will help with classification and compliance.