7311.00.00

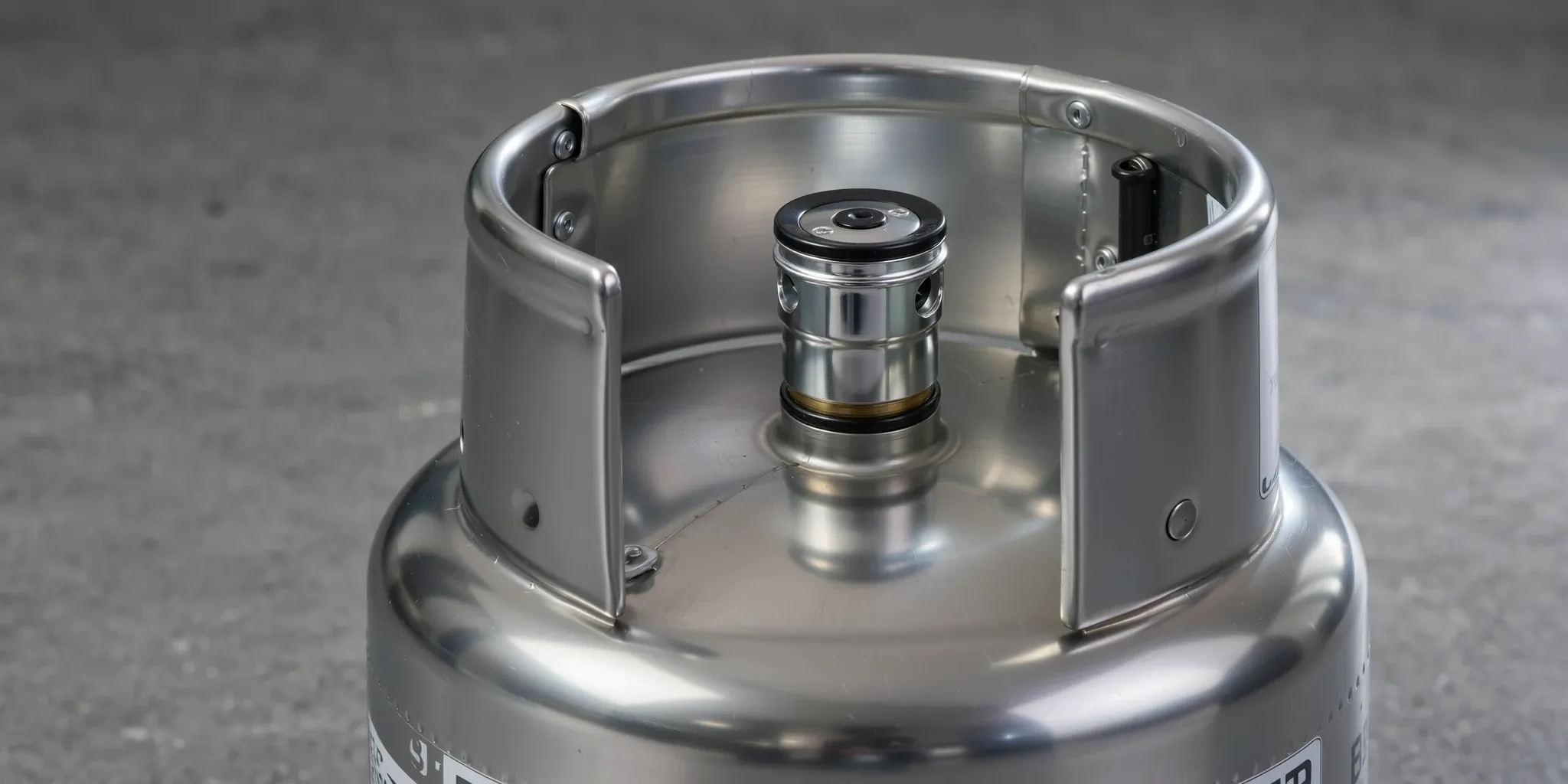

Containers for compressed or liquefied gas, of iron or steel

This code covers containers made of iron or steel designed for compressed or liquefied gas. Use this code when importing these containers, as the general duty is free for standard trade partners, though special rates may apply under eligible free trade agreements or preference programs as detailed within Chapter 73.

Detailed information for HTS Code 7311.00.00

AI Summary

This tariff classification falls within Chapter 73, which covers articles of iron or steel. Specifically, code 7311.00.00 covers containers designed for compressed or liquefied gas, made of iron or steel. This code is further broken down by certifications and container types, with subdivisions 7311.00.00.30 for seamless steel containers meeting specific DOT standards, 7311.00.00.60 for other certified containers, and 7311.00.00.90 for all other containers not falling into the previous categories; choose the appropriate statistical suffix based on the container’s certification and construction type.

| Chapter | Chapter 73 - Articles of iron or steel |

| Section | Section XV - Base Metals and Articles of Base Metal |

Duty snapshot

Quick reference for the duty outcomes tied to this HTS line.

Free

Standard trade partners (NTR)

N/A

Eligible FTA or preference programs

The general rate of duty for HTS code 7311.00.00 and all its subdivisions (7311.00.00.30, 7311.00.00.60, and 7311.00.00.90) is Free, applying to goods originating from standard trade partners (NTR). Special rates are not specified, but may apply to goods eligible for Free Trade Agreements or other preference programs. Reporting units are both 'No.' (number of containers) and 'kg' (kilograms), and must be declared as such. These duty rates apply uniformly to all subdivisions under 7311.00.00, regardless of the specific container type or certification status.

Rate of Duty (Column 2): 25%

Need help importing?

_

Submit your details, and our team will confirm the correct classification and answer your questions.

Code subdivisions

7311.00.00.30

Containers for compressed or liquefied gas, of iron or steel > Certified prior to exportation to have been made in accordance with the safety requirements of sections 178.36 through 178.68 of title 49 CFR or under a specific exemption to those requirements: > Seamless steel containers not overwrapped, marked DOT 3A, 3AX, 3AA, 3AAX, 3B, 3E, 3HT, 3T or DOT-E followed by a specific exemption number

7311.00.00.60

Containers for compressed or liquefied gas, of iron or steel > Certified prior to exportation to have been made in accordance with the safety requirements of sections 178.36 through 178.68 of title 49 CFR or under a specific exemption to those requirements: > Other

7311.00.00.90

Containers for compressed or liquefied gas, of iron or steel > Other

Chapter & section notes

Chapter notes

Section notes

Latest update

Last updated

November 15, 2025

Revised every January & July

Let's get your shipment cleared

Submit your details and our team will help with classification and compliance.