7408.19.00

Other

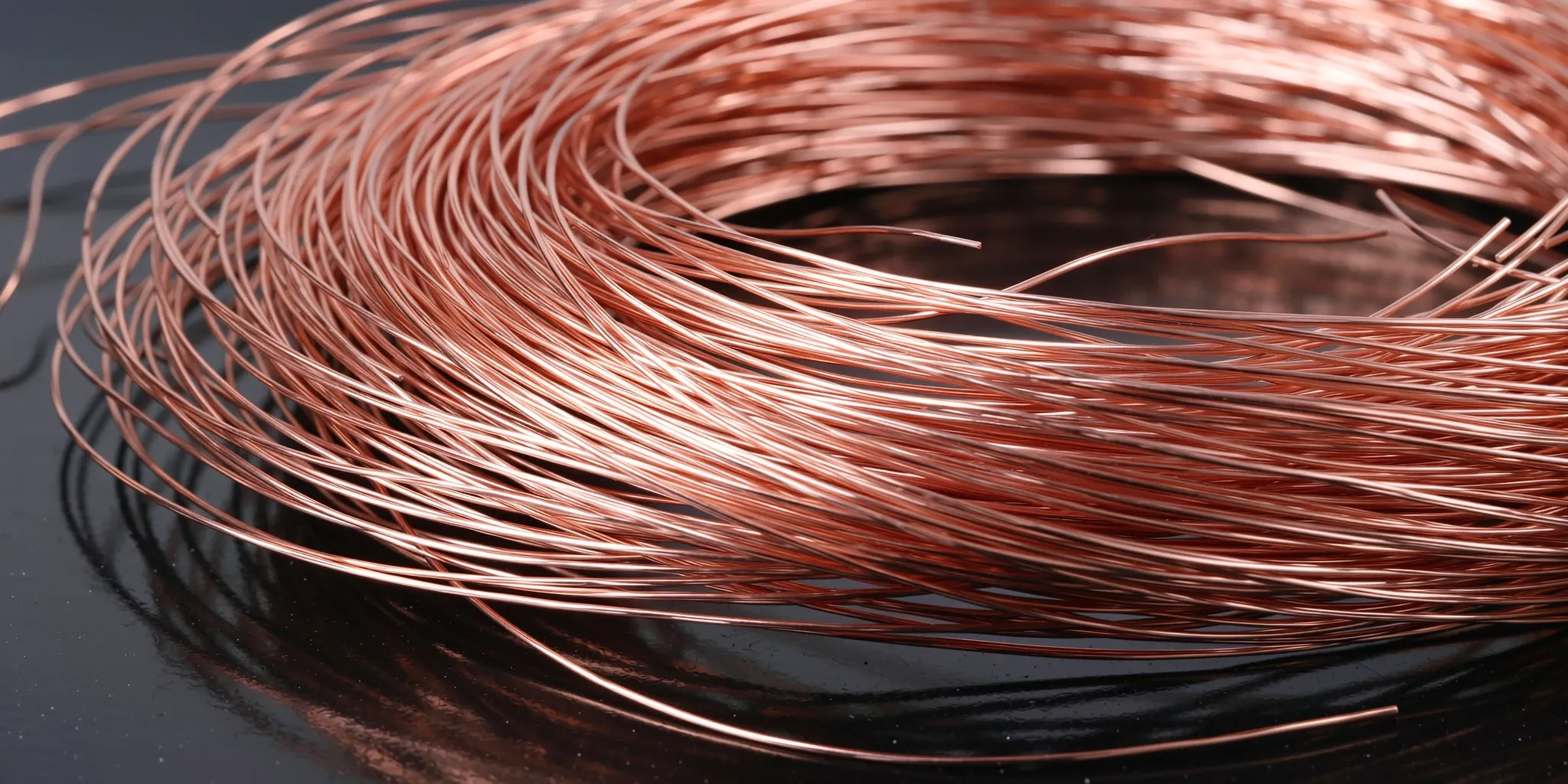

HTS code 7408.19.00 covers refined copper wire, excluding alloys. Use this code when importing this type of wire to determine the applicable 3% general duty, or potentially free duty if the goods qualify for special trade programs as outlined in the documentation, and understand its placement within the broader copper product classifications.

Detailed information for HTS Code 7408.19.00

AI Summary

This tariff code falls within Chapter 74, which covers copper and articles thereof. Specifically, 7408.19.00 covers refined copper wire that is *not* electrically insulated. This code further specifies wire that is 'other' than that covered by more specific codes within the 7408.19 section. There are two statistical suffixes available: 7408.19.00.30 for wire with a maximum cross-sectional dimension of 3 mm or less, and 7408.19.00.60 for all other wire; choose the suffix that accurately describes the wire's dimensions.

| Chapter | Chapter 74 - Copper and articles thereof |

| Section | Section XV - Base Metals and Articles of Base Metal |

Duty snapshot

Quick reference for the duty outcomes tied to this HTS line.

3%

Standard trade partners (NTR)

Free (A*,AU,BH,CL,CO,D,E,IL,JO,KR,MA,OM,P,PA,PE,S,SG)

Eligible FTA or preference programs

The general duty rate for HTS code 7408.19.00 and its subdivisions (7408.19.00.30 & 7408.19.00.60) is 3%, applying to imports not qualifying for preferential treatment. Special rates offer free duty (0%) for goods originating from specific countries including Australia (AU), Bahrain (BH), and others listed (A*,CL,CO,D,E,IL,JO,KR,MA,OM,P,PA,PE,S,SG) if they meet the requirements of eligible Free Trade Agreements or preference programs. All imports under this code and its subdivisions must be reported in kilograms (kg). No specific section information is provided.

Rate of Duty (Column 2): 28%

Need help importing?

_

Submit your details, and our team will confirm the correct classification and answer your questions.

Code subdivisions

7408.19.00.30

Copper wire: > Of refined copper: > Other > With a maximum cross-sectional dimension of 3 mm or less

7408.19.00.60

Copper wire: > Of refined copper: > Other > Other

Chapter & section notes

Chapter notes

Section notes

Latest update

Last updated

November 15, 2025

Revised every January & July

Let's get your shipment cleared

Submit your details and our team will help with classification and compliance.