7419.80.06

Other

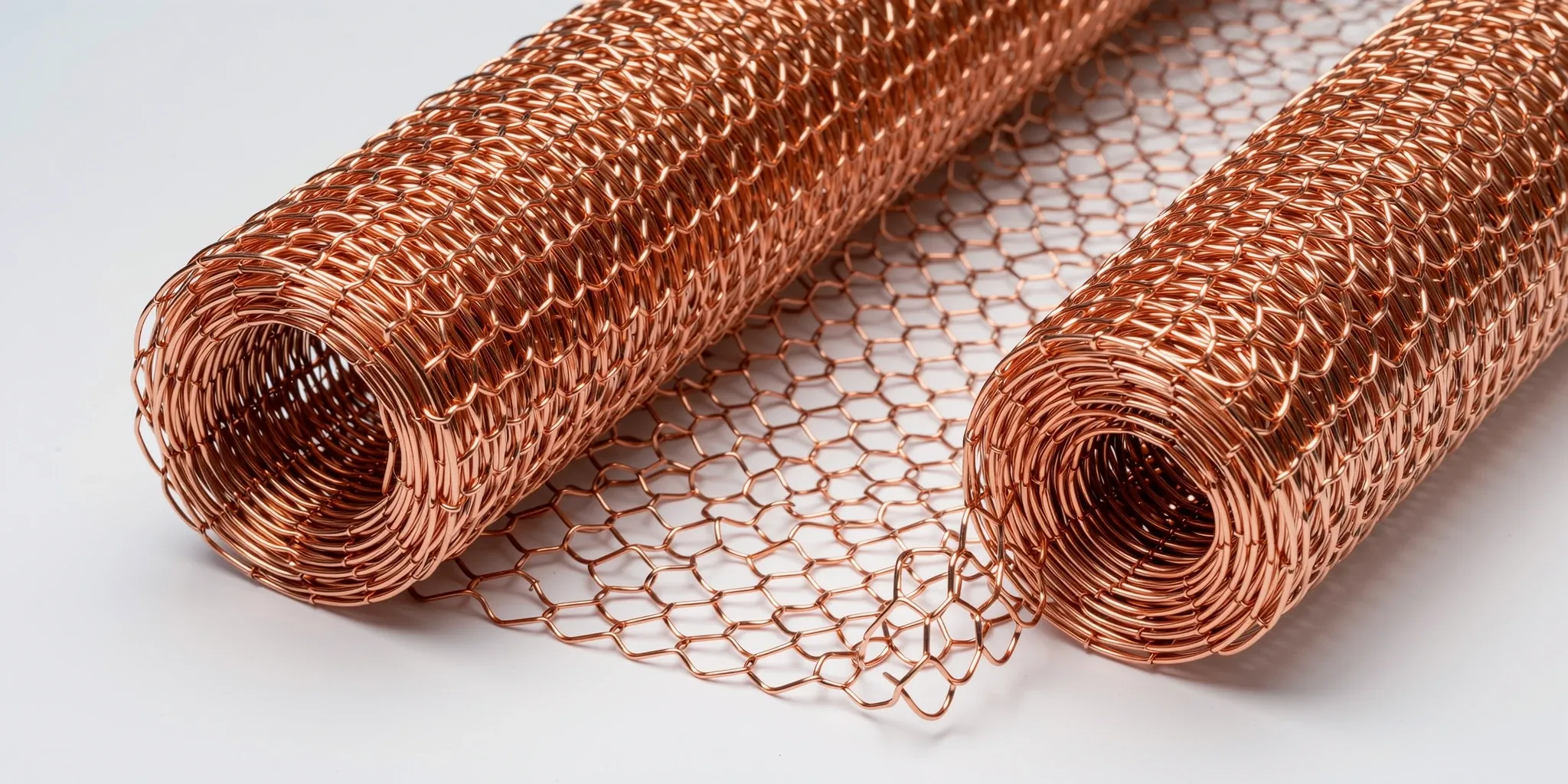

HTS code 7419.80.06 covers miscellaneous articles of copper, specifically copper cloth, grill, netting, or expanded metal. Use this code for importing these copper items, keeping in mind a general duty rate of 3% applies, while preferential rates (potentially free) may apply to goods from certain trade partners as detailed in the duty information.

Detailed information for HTS Code 7419.80.06

AI Summary

This tariff code falls within Chapter 74, which covers copper and articles thereof. Specifically, 7419.80.06 covers other articles of copper, namely cloth, grill, and netting of copper wire or expanded metal. This code has two subdivisions: 7419.80.06.60 for Fourdrinier wires used in papermaking machines, and 7419.80.06.80 for all other cloth, grill and netting of this type; choose the appropriate statistical suffix based on whether the article is a Fourdrinier wire or another type of copper cloth, grill or netting.

| Chapter | Chapter 74 - Copper and articles thereof |

| Section | Section XV - Base Metals and Articles of Base Metal |

Duty snapshot

Quick reference for the duty outcomes tied to this HTS line.

3%

Standard trade partners (NTR)

Free (A,AU,BH,CL,CO,D,E,IL,JO,KR,MA,OM,P,PA,PE,S,SG)

Eligible FTA or preference programs

The general duty rate for HTS code 7419.80.06 is 3%, applying to all origins unless a special rate applies. Special duty rates are free for goods originating from A, AU, BH, CL, CO, D, E, IL, JO, KR, MA, OM, P, PA, PE, S, or SG, contingent on meeting the rules of origin for eligible FTA or preference programs. Both the main code and its subdivisions (7419.80.06.60 and 7419.80.06.80) are subject to these rates. Reporting units are in m2 or kg. There is no information about other special rates or if the subdivisions have different duty rates.

Rate of Duty (Column 2): 43%

Need help importing?

_

Submit your details, and our team will confirm the correct classification and answer your questions.

Code subdivisions

7419.80.06.60

Other articles of copper: > Other: > Cloth (including endless bands), grill and netting, of copper wire; expanded metal of copper: > Cloth: > Other > Fourdrinier wires, seamed or not seamed, suitable for use in papermaking machines, with fewer than 94 or more wires to the lineal centimeter

7419.80.06.80

Other articles of copper: > Other: > Cloth (including endless bands), grill and netting, of copper wire; expanded metal of copper: > Cloth: > Other > Other

Chapter & section notes

Chapter notes

Section notes

Latest update

Last updated

November 15, 2025

Revised every January & July

Let's get your shipment cleared

Submit your details and our team will help with classification and compliance.