7606.92.30

Not clad

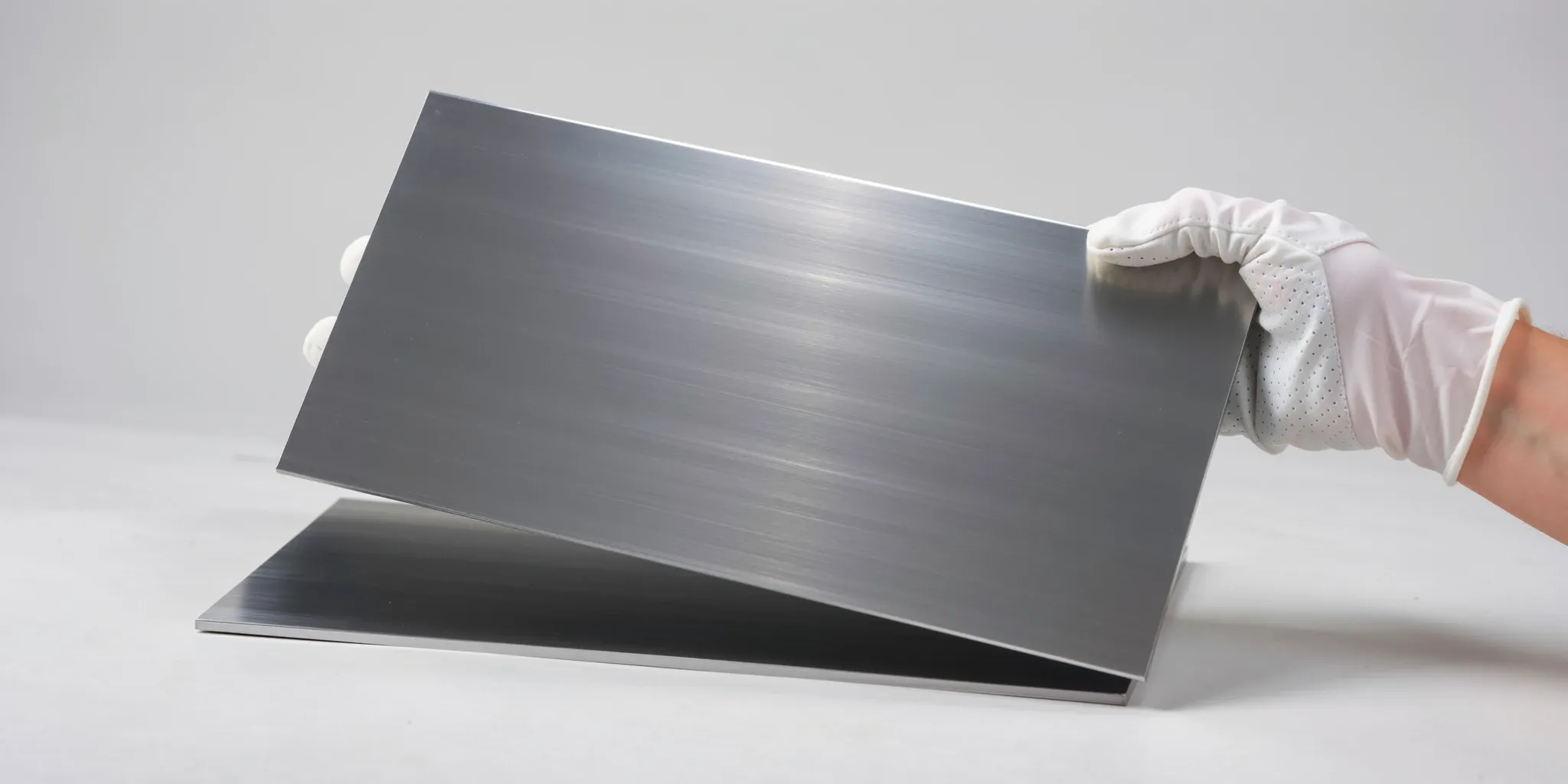

This code covers aluminum plates, sheets, and strip—specifically those *not* clad—of varying thicknesses and alloys. Use this code when importing these aluminum products to determine the applicable 3% general duty, or potential free duty if the goods qualify for specific trade programs as outlined in the chapter notes.

Detailed information for HTS Code 7606.92.30

AI Summary

This tariff code falls within Chapter 76, which covers aluminum and articles thereof. The specific code, 7606.92.30, covers aluminum plates, sheets, and strip of a thickness exceeding 0.2 mm that are not clad and made of aluminum alloys. This code further breaks down into two subdivisions based on thickness: 7606.92.30.25 for those exceeding 6.3 mm in thickness and 7606.92.30.35 for those 6.3 mm or less, so be sure to select the correct statistical suffix based on the material’s thickness.

| Chapter | Chapter 76 - Aluminum and articles thereof |

| Section | Section XV - Base Metals and Articles of Base Metal |

Duty snapshot

Quick reference for the duty outcomes tied to this HTS line.

3%

Standard trade partners (NTR)

Free (A,AU,BH,CL,CO,D,E,IL,JO,KR,MA,OM,P,PA,PE,S,SG)

Eligible FTA or preference programs

The general duty rate for HTS code 7606.92.30 and its subdivisions (7606.92.30.25 & 7606.92.30.35) is 3%, applicable to goods not qualifying for special rates. Special duty rates are free for goods originating from specific countries (A, AU, BH, CL, CO, D, E, IL, JO, KR, MA, OM, P, PA, PE, S, SG) and eligible for FTA or preference programs. All quantities are reported in kilograms (kg). The special rate applies if the goods meet the rules of origin and other requirements of the relevant free trade agreement or preference program; otherwise, the 3% general rate applies.

Rate of Duty (Column 2): 13.50%

Need help importing?

_

Submit your details, and our team will confirm the correct classification and answer your questions.

Code subdivisions

7606.92.30.25

Aluminum plates, sheets and strip, of a thickness exceeding 0.2 mm: > Other: > Of aluminum alloys: > Not clad > With a thickness of more than 6.3 mm

7606.92.30.35

Aluminum plates, sheets and strip, of a thickness exceeding 0.2 mm: > Other: > Of aluminum alloys: > Not clad > With a thickness of 6.3 mm or less

Chapter & section notes

Chapter notes

Section notes

Latest update

Last updated

November 15, 2025

Revised every January & July

Let's get your shipment cleared

Submit your details and our team will help with classification and compliance.